GST payment

My business is not GST-registered but is Customs-approved. An annual filer and have to remit.

Export Of Goods Without Payment Of Igst Gst Refunds Part 1

OTTAWA ON Nov.

. This is the 28th of the month after the end of your taxable period. For example the taxable period ending 31 May is due 28 June. Most GSTHST payments are due at the same time as your GSTHST returns.

Heres a step by step process for how to make your GST payment online. Set-off the tax liability by using the credit available in Electronic credit ledger. 201 Ottawa unveils 45B affordability plan including dental care GST credit Millions of Canadians woke up Friday morning with hundreds of dollars from Canadas federal.

A sign outside the Canada Revenue Agency is seen in Ottawa Monday May 10 2021. Find out how you can pay your GST for imports or goods and. For 2022 to 2023 the highest possible payments are 467 for singles.

60000 and have 3 or 4 children. The GST payment dates in 2023 are on January 5 2023 April 5 2023 July 5 2023 and October 5 2023. 50000 to 55000 with one child or more.

You can receive your payments via direct deposit to your Canadian bank. Site best viewed at 1024 x 768 resolution in Microsoft Edge Google Chrome 49 Firefox 45 and Safari 6. Single Canadians who earn 45000 or.

To support those most affected by inflation the Government of Canada is issuing an additional 25 billion through GST credit payments to assist more than 11 million Canadian individuals. Quarterly if your GST turnover is less than 20 million and we have. Your goods will be released automatically when they arrive in Jersey although you wont benefit from the de minimus you.

Deposit money in the. Goods and Services Tax. Canadians eligible for the GST rebate can expect to receive an additional lump sum.

Find out what happens if your business does not submit a GST return and or pay tax due by the required date. This is an amount we. Please make sure to read terms and conditions before going ahead with GST payment online.

If your business income is reasonably consistent throughout the year you might prefer to pay a GST instalment amount option 3 in your business activity statement. And in 2023 the payment dates. Share this article.

How much is the 2022 GST credit. How to pay GST. Tax refunds made via PayNow receiving GST and Corporate Tax refunds and GIRO will be received within 7 days from the.

Your GST payment is due on the same day as your GST return. If you do not receive your GSTHST credit. Generally tax credits of at least 15 are automatically refunded.

Monthly if your GST turnover is 20 million or more. In 2022 the payment dates are as follows and are based on your 2020 return. Your GST reporting and payment cycle will be one of the following.

4 2022 CNW Telbec - The first of the Government of Canadas new financial support measures will take effect this Friday November 4 2022 with the. It depends on your income level marital status and number of children. Single Canadians qualify for a GST HST credit if you earn.

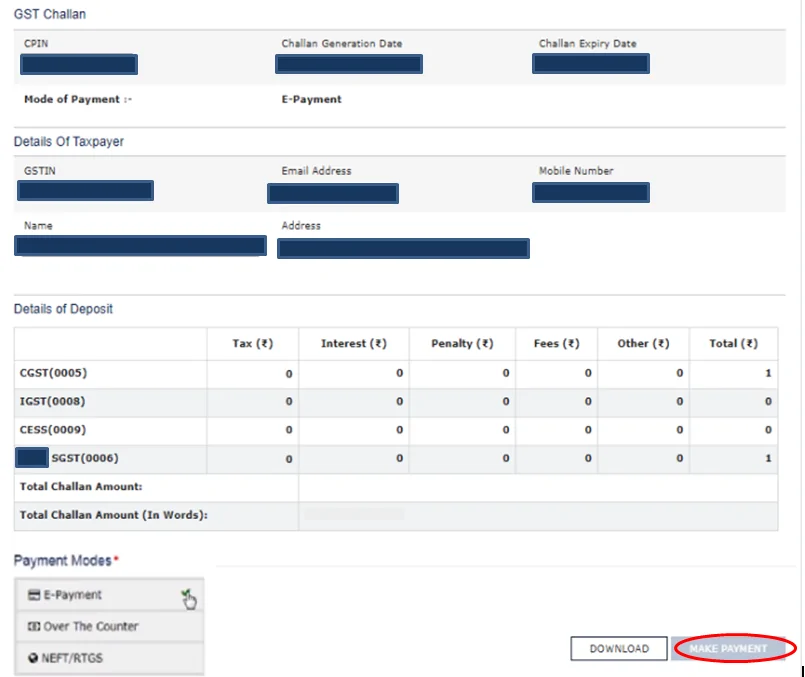

4 2022 CNW Telbec - The first of the Government of Canadas new financial support measures will take effect this Friday November. The Canada Revenue Agency usually send the GSTHST credit payments on the fifth day of July October January and April. After choosing your GST online payment mode click on Make Payment.

Your payment deadline is different than your filing deadline if you are either.

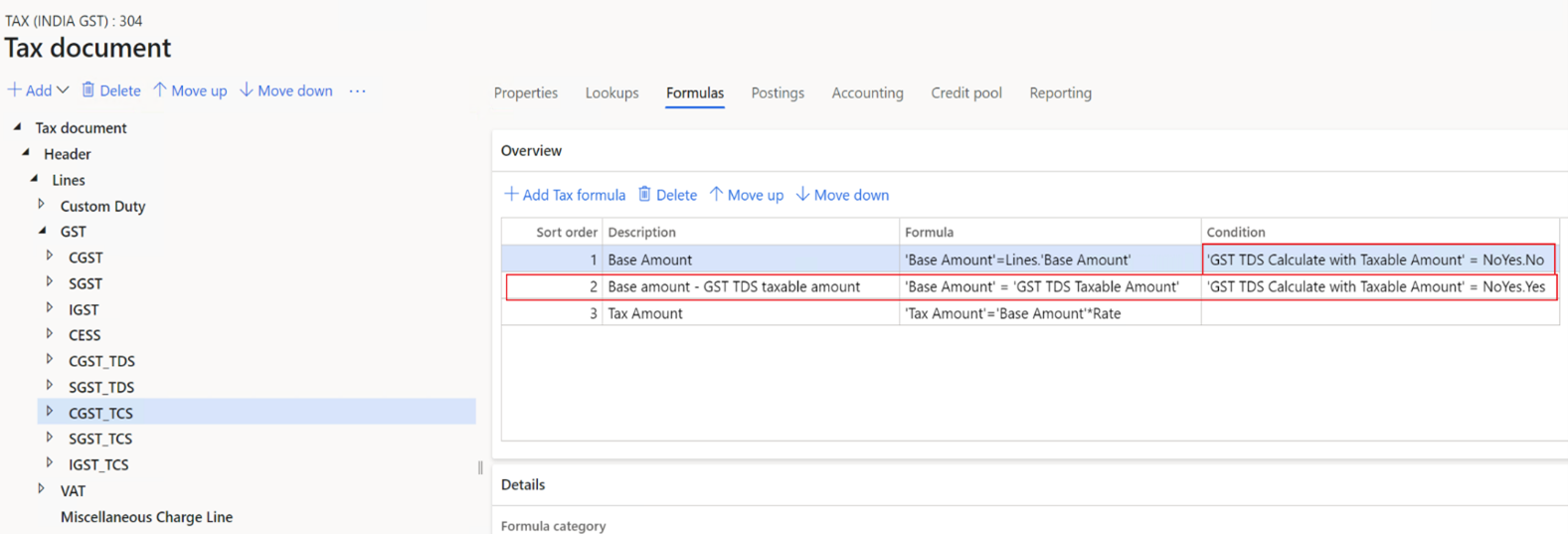

Gst Tcs On Payment Of Goods And Services Finance Dynamics 365 Microsoft Learn

Gst Payment Online Status Timings Process Paisabazaar Com

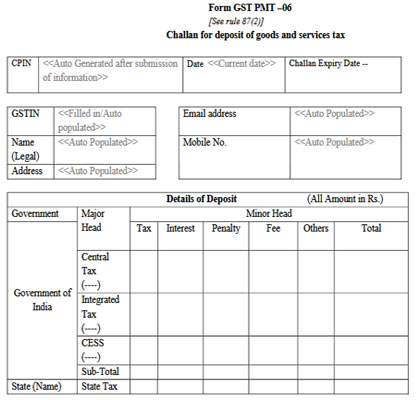

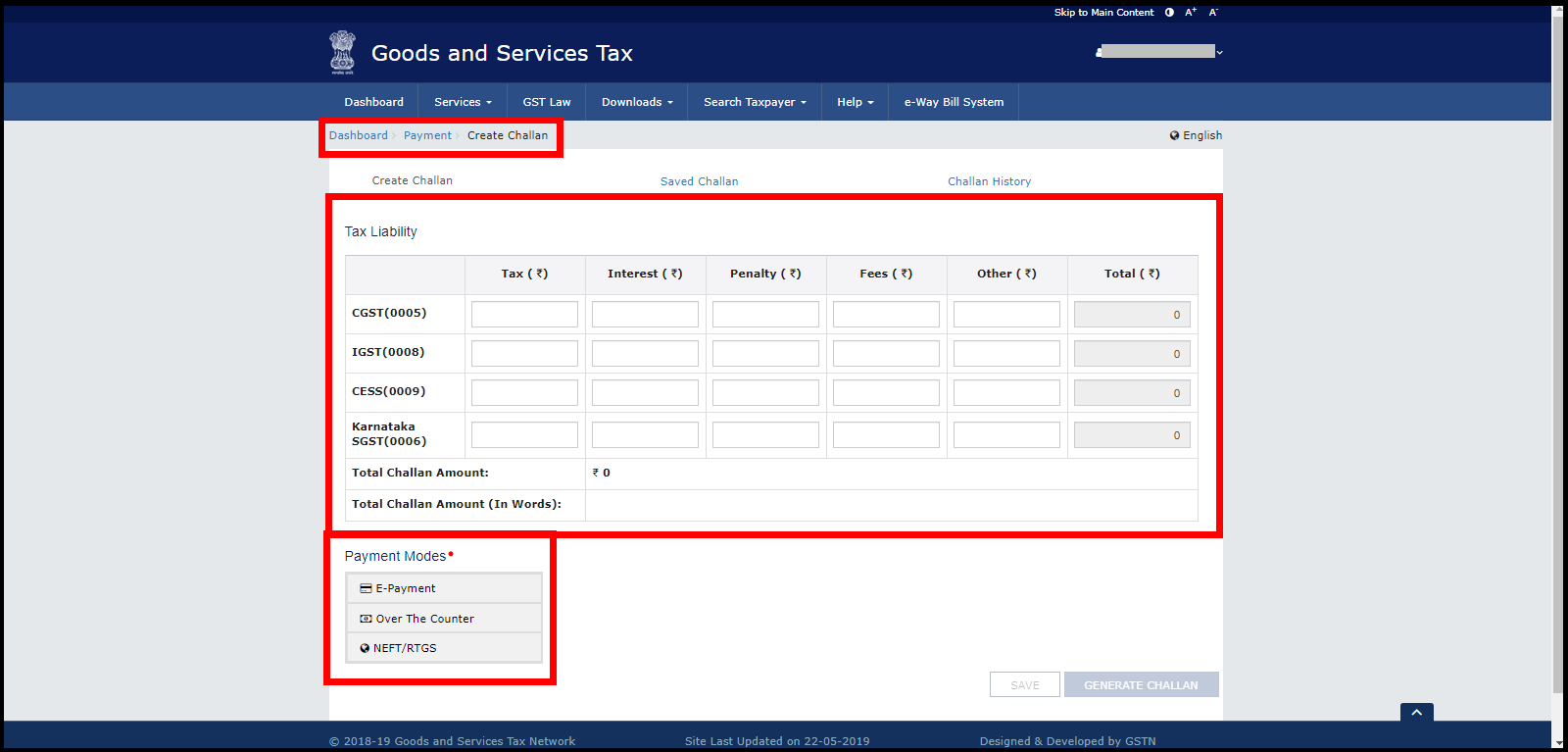

Create Gst Payment Challan Step By Step Guide On Gst Portal Indiafilings

Gst Need To Make Additional Gst Payment Here S How To Go About It

Recording Gst Payments On Imports

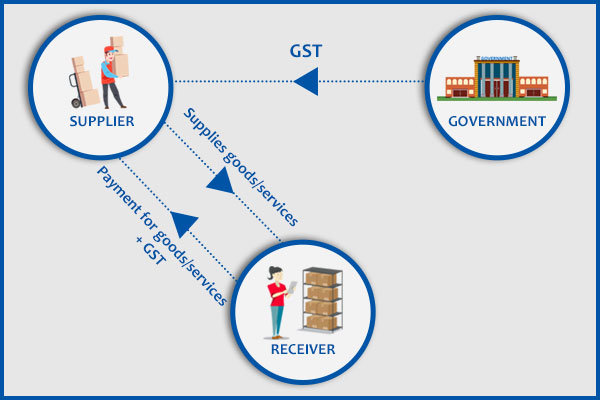

How To Calculate Gst Payments And Refunds In India

How To View Challan Reconciliation Report In Tallyprime Tallyhelp

How To Make Gst Payment Gst Payment Process Gst Create Challan

Payment Gst Challan Cpin Cin Siddharth Agarwal Youtube

Can Gst Be Paid By Using A Credit Card Iim Skills

Training Modular Financial Modeling Ii Sales Taxes Gst Gst Payment Timing Modano

Steps For Gst Payment Challan Through Gst Portal

How To Pay Gst Online Gst Payment Process Rules Form